Welcome to

Plouta Financial Wellness Hub

Your go-to source for clear, practical advice on budgeting, investing, pensions, tax and more helping you make smarter money decisions at every stage of life.

Explore our latest articles that help you make smarter financial choices

Filter by category

- Budgeting

- Capital Gains Tax

- Crypto Investment

- Family Protection

- Financial Freedom

- ISAs & Tax-Free Investing

- Inheritance Tax (IHT)

- Insurance

- Investment Platform Reviews

- Managing Your Pension

- Money Books Worth Reading

- Money Saving Checklists

- Mortgages & Property

- Pension Provider Reviews

- Retirement Planning Tips

- Saving and Investing

- Tax and Business

- Tools & Calculators

- Trusts, Wills & Estate Planning

- Wealth Building Tips

Top Life Insurance Advisers Near Me

Looking for life insurance advice near you? Plouta connects you with expert partnered protection advisers who visit you at home across the UK. Protect your legacy today.

Why Insurance is the Foundation of Your Financial Wellness

Learn why insurance is essential for your financial plan. Discover how protection preserves wealth, manages risk, and provides a safety net for UK families.

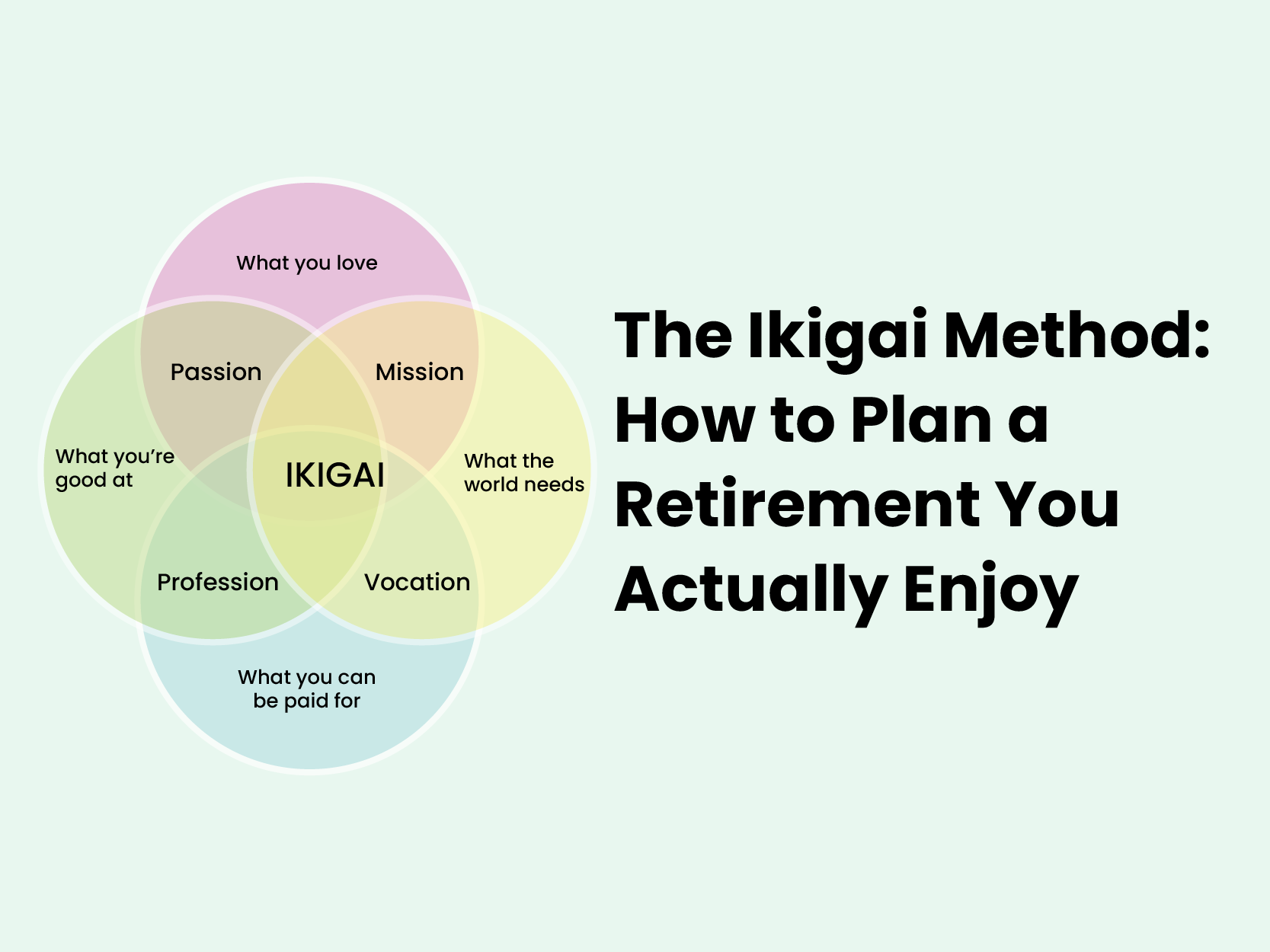

The Ikigai Method: How to Plan a Retirement You Actually Enjoy

Worried about boredom in retirement? Use our practical Ikigai framework to identify your passions, skills and how to stay active and happy in your later years.

Rachel Reeves’ Autumn Budget 2025: Key Tax, Pension & IHT Changes Explained

A complete 2026 roadmap for UK young professionals to build a solid emergency fund. Learn how much to save, the best accounts for falling rates, and how to balance rent and student loans.

Complete Guide to Building Your Emergency Fund in 2026: Young Professional's Roadmap

A complete 2026 roadmap for UK young professionals to build a solid emergency fund. Learn how much to save, the best accounts for falling rates, and how to balance rent and student loans.

Do I Need Personal Tax Advice? A Guide to Knowing When to Call an Expert

When should you hire a UK tax adviser? Our guide explains the cost, the benefits, the difference between accountants and tax advisers and the 8 key signs you need advice.

When Do I Need a Financial Adviser?

A guide on when to hire a UK financial adviser. We explain the cost (flat fee vs. %), the difference between Independent and Restricted and the value they add.

7 Investing Myths That Are Keeping You From Financial Freedom

Are investing myths holding you back? Our guide debunks common fears about gambling, risk, knowledge and cost, showing you how to start building wealth.

How Am I Protected if Something Goes Wrong with My FCA Regulated Financial Adviser?

Understand the protections you have with an FCA-regulated financial adviser in the UK. Learn about FOS and FSCS compensation if advice goes wrong.

How Can I Achieve Financial Independence in the UK

Your UK guide to achieving Financial Independence. Learn how to calculate your Financial independence number, save aggressively, invest wisely and reach early retirement sooner.

Financial Independence vs Financial Freedom: What's Your Ultimate Goal?

A UK guide explaining the difference between Financial Independence (FI) and Financial Freedom (FF). Learn how to define your goals and achieve true financial control.

How to Protect Yourself from Scammers in the UK

Protect your money from common UK scams. Our guide details investment, impersonation, job scams, phishing, SIM swaps & how to stay safe.

UK Crypto Tax Explained: Your Guide to HMRC Rules

A clear guide to UK crypto tax for 2025/26. Learn how HMRC taxes Bitcoin & other crypto assets, including CGT, Income Tax, allowances and reporting rules.

New UK Crypto Rules Explained: What Investors Need to Know

A guide to the latest UK crypto regulations. Understand the new FCA rules on promotions, stablecoin plans, tax and what it means for your crypto investments.

Claim Your Pension Tax Relief: UK Pension Tax Relief Explained

Our guide explains UK pension tax relief. Learn how the government boosts your pension contributions and how to claim relief at your highest tax rate.

Pension Consolidation Explained: How to Combine Your Pension Pots in the UK

Thinking about combining your pension pots? Learn how pension consolidation works, what to check before transferring and when it makes sense. Discover the benefits, risks and step-by-step guide for UK savers planning a simpler retirement.

How to Choose Your Pension Drawdown Provider: The Key to a Flexible Retirement

How to choose the best pension drawdown provider in the UK. Compare fees, investment choice, flexibility, and service to manage your retirement income.

3 in 4 People Are NOT Ready To Retire – Here’s Why (and What You Can Do About It)

Shocking stats reveal 75% of UK adults may not be ready for retirement. Our guide explores why people are undersaving and how to take control of your future.

SIPP vs. ISA: Which is the Best UK Investment Account?

A UK financial adviser's guide comparing a SIPP vs. a Stocks & Shares ISA. Learn about tax relief, allowances and which is best for your retirement goals.

5 Ways to Give Your Pension Savings a Boost in the UK

A UK financial adviser's guide to boosting your pension. Learn 5 powerful tips to supercharge your retirement savings, from employer matching to tax reliefs.

Join the Plouta Financial Wellness Community

Financial wellbeing means feeling confident and in control of your money now and in the future. It’s about reducing stress, making smart decisions, and being prepared for life’s surprises.