The Ikigai Method: How to Plan a Retirement You Actually Enjoy

Retirement is often painted as a destination—a golden shore where you finally stop working. But for many, hitting that shore brings an unexpected wave of emptiness. The phone stops ringing, the schedule clears, and a quiet question gets louder: "Who am I now?"

The Japanese concept of Ikigai (pronounced ee-key-guy) offers a powerful antidote to this modern dilemma. Often translated as "a reason for being," it is the anti-retirement philosophy that keeps the residents of Okinawa living happy, active lives well into their 100s.

For those planning to retire, Ikigai isn't just a nice idea; it’s a practical framework for designing a life that feels as meaningful as the career you’re leaving behind.

What is Ikigai? (Beyond the Venn Diagram)

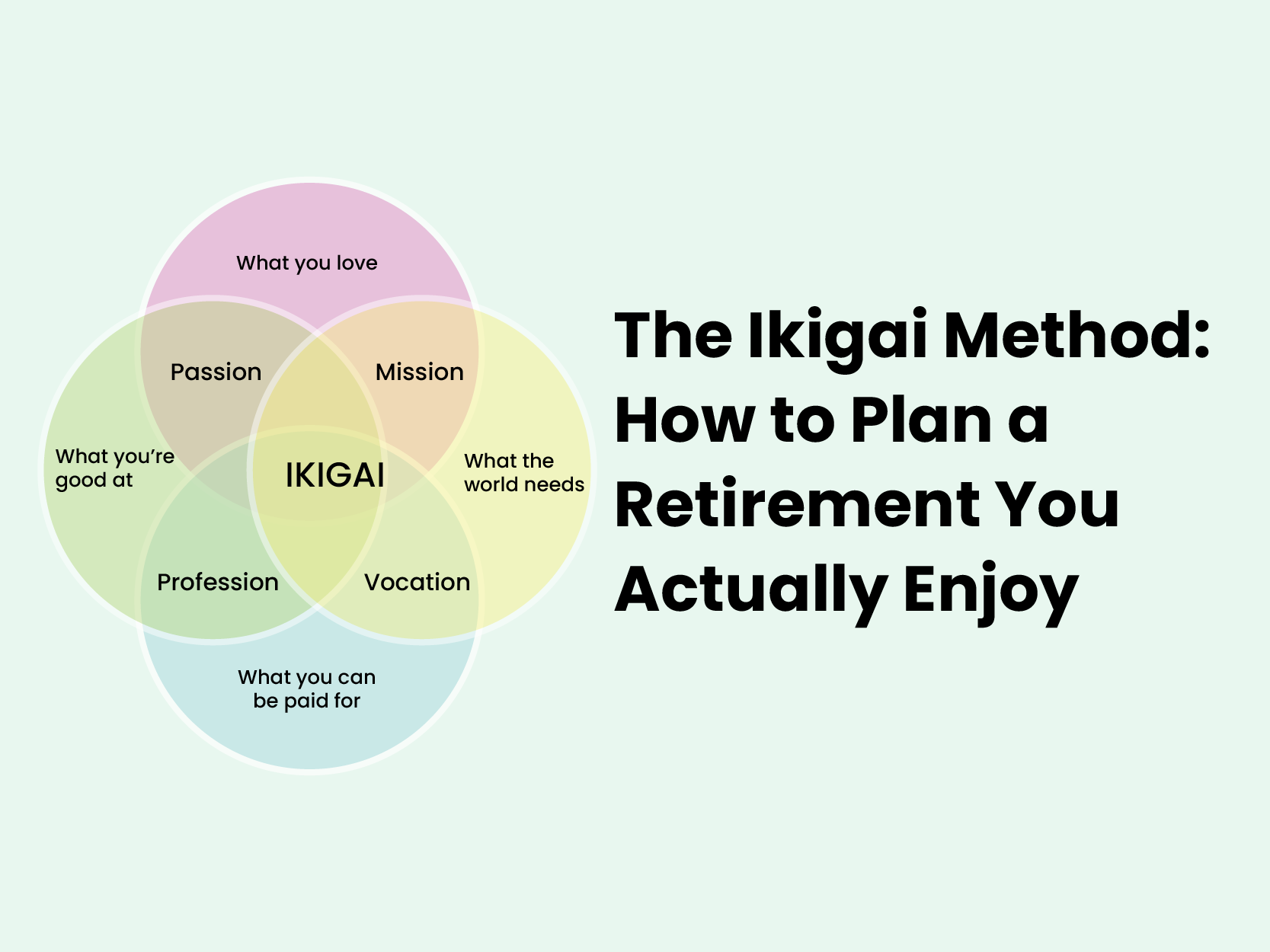

You may have seen the popular Westernized "Venn diagram" of Ikigai, which suggests your purpose lies at the intersection of four circles:

What you love

What you are good at

What the world needs

What you can be paid for

While useful for career planning, this model has a flaw for retirees: it overemphasizes money. In traditional Japanese culture, Ikigai is broader. It’s the joy of the little things—the morning coffee, the smile of a grandchild, the hum of a well-tended garden. It is less about a "grand ambition" and more about the happiness of always being busy with things that matter to you.

Adapting the 4 Circles for Retirement

To make the Ikigai framework work for retirement, we need to tweak the fourth circle. Instead of "What you can be paid for," think of it as "What you are valued for" or "What sustains you."

The Ikigai Workshop: Finding Your Purpose

If you are planning your retirement, set aside an afternoon to do this "Ikigai Audit." Don't just think about it—write it down.

Step 1: Dig for "Micro-Flow"

Look back at your life and identify moments of "flow"—times when you were so engrossed in an activity that you forgot to eat or check your phone.

Was it when you were training a junior employee? (Mentorship)

Was it planning the family vacation itinerary? (Logistics/Research)

Was it fixing the leaky sink? (Problem-solving/Handiwork)

Step 2: The "100-Year-Old" Test

Ask yourself: If I live to be 100, what activity could I do every day that wouldn't bore me? In Japan, it’s common to see 90-year-olds who are master craftsmen or gardeners. They don't retire; they just refine. Your Ikigai doesn't have to be "saving the whales." It can be as simple as baking the perfect loaf of bread or curating a local history archive.

Step 3: Reframe Your "Paid" Skills

Retirement is the time to decouple your skills from your salary.

The Corporate Lawyer: Instead of reviewing contracts for a fee, they might help a non-profit navigate legal hurdles pro bono (Mission + Vocation).

The Accountant: Instead of tax audits, they might act as treasurer for a local club, ensuring it stays afloat (Strengths + Community Need).

Real-Life Examples of Retirement Ikigai

Seeing how others have navigated this shift can spark your own ideas.

1. The "Sustainability Guru" (From Corporate to Community) Sarah, a retired corporate manager, thought she wanted a quiet life of gardening. But she quickly grew bored. She realized her "strength" was organizing people and her "love" was nature.

Her Ikigai: She started a "Ridiculous Recycling Contest" at her local community center to teach kids about waste.

The Result: She wasn't just "Sarah the retired lady"; she became a local sustainability expert. She found a way to use her management skills (organizing) for what the world needed (environmental education) in a way she loved.

2. "Mama Sofia" (The Connection Seeker) Sofia felt burned out by a high-pressure job and traveled to Tanzania to volunteer building teacher accommodations. She realized her "flow" state came not from the construction, but from connecting with the local children and families.

Her Ikigai: She didn't need to become a builder. She needed to be a connector and helper. Upon returning, she focused her retirement on social causes and community support, replacing the "busy-ness" of work with the deep human connection she craved.

The "Anti-Retirement" Lifestyle

Embracing the Ikigai way often means rejecting the Western ideal of the "permanent vacation." A life of pure leisure often fails to satisfy the human need for competence and contribution.

The Moai (Social Support Group)

In Okinawa, elders form Moai—groups of 5 friends who commit to supporting each other for life.

Action Item: Don't rely solely on your spouse for social interaction. Before you retire, actively build your own "board of directors" or Moai—a small group of friends you meet with weekly, not just for fun, but for emotional and practical support.

Radio Taiso (Movement)

You can't pursue your purpose if your body fails you. In Japan, millions of people, including the elderly, practice Radio Taiso—a 3-minute calisthenics routine done to music every morning.

Action Item: Build a "movement anchor" into your day. It signals to your brain that the day has started and you have things to do, preventing the lethargy of unstructured time.

Summary: Your Retirement Checklist

Stop asking: "What will I do to relax?"

Start asking: "What will I do to be useful?"

Identify your Flow: Find the intersection of what you love and what you’re good at.

Find a need: Look for a place in your community that needs those skills.

Move your body: Establish a daily physical ritual to support your longevity.

Retirement isn't the end of the road; it's just the start of the section where you finally get to choose the destination. Find your Ikigai, and you’ll never truly "retire" a day in your life.

Take control of your retirement, starting today.

Use Plouta to track your savings, forecast your retirement and get clear, practical advice tailored to your goals.

Disclaimer: This guide provides general information about retirement planning and lifestyle philosophies (such as Ikigai) and is for informational, educational, and inspirational purposes only. It does not constitute financial, medical, or psychological advice. Retirement planning involves complex financial decisions. The value of investments can go down as well as up, and tax rules can change. While a sense of purpose is vital for well-being, your financial security in retirement depends on your individual circumstances. Always seek professional, regulated financial advice tailored to your specific situation before making significant changes to your pension or investment strategy.